Lately, I’ve been on a crusade to help business owners register family trusts. It’s a brilliant move, trusts are designed to protect your assets, ensure smooth succession, and keep your wealth safe from chaos.

But here’s the problem: most people in Zimbabwe are registering family trusts the same way they register gym memberships in January. Lots of excitement, selfies with the certificate… and then nothing happens. No assets, no shares, no properties transferred. Just a framed document gathering dust.

And when the storm comes, that trust is as useful as a brick in a swimming pool.

Mr. Chitombo was a big businessman in Harare. He had:

-

Two houses in Borrowdale

-

A lodge in Kariba

-

A trucking business

-

And a farm full of cattle and chickens

One day, at a business seminar, someone said:

“Register a family trust and secure your wealth for generations!”

Mr. Chitombo clapped so hard, people thought he was the keynote speaker. The next morning, he rushed to the Deeds Office and registered The Chitombo Family Trust**.**

He framed the certificate and showed it off to his friends like it was a trophy. “Now my family is secure,” he boasted.

But here’s the catch: he never moved his assets into the trust. Everything the houses, the trucks, the farm, the lodge remained in his personal name.

Years later, Mr. Chitombo passed away. His family gathered for the reading of the will, and the lawyer broke the news:

“Unfortunately, although there is a trust, no assets were ever transferred into it. Legally, the trust owns nothing.”

Silence. Then pandemonium.

-

The Borrowdale house was claimed by the second wife.

-

The trucks were grabbed by creditors.

-

The Kariba lodge was auctioned off because of unpaid electricity bills.

-

The farm? Cousin Tonde, who had been “helping out,” suddenly declared himself the new owner.

And that beautiful trust deed? The grandchildren now use it to cover their schoolbooks.

Registering a family trust without moving assets into it is like:

-

Buying a safe but leaving your money under the mattress.

-

Paying lobola but never taking your wife home.

-

Owning a kombi but refusing to buy fuel.

It’s just vibes.

To make matters worse, most trusts I see are generic copy-and-paste documents with loopholes big enough to drive a haulage truck through. They say things like:

“The trustees shall manage the assets of the trust…” But which assets? None are listed. None are transferred. It’s English with zero value.

So, What Should You Do?

If you want your trust to actually work:

-

Move assets into it. Properties, shares, farms, companies don’t delay.

-

Customize your deed. Don’t settle for a one-size-fits-all document.

-

Review it regularly. Life changes. So should your trust.

-

Get expert help. Don’t leave your family’s future to a DIY job.

** **

A Family Trust is like a granary. If you build one but never put maize inside, your children will still starve when drought comes.

So stop creating “Pillow Trusts” those beautiful documents that live under the pillow but hold no wealth. Secure your legacy properly. Because the day you’re gone, you don’t want your children fighting over goats, wheelbarrows, and the last loaf of bread.

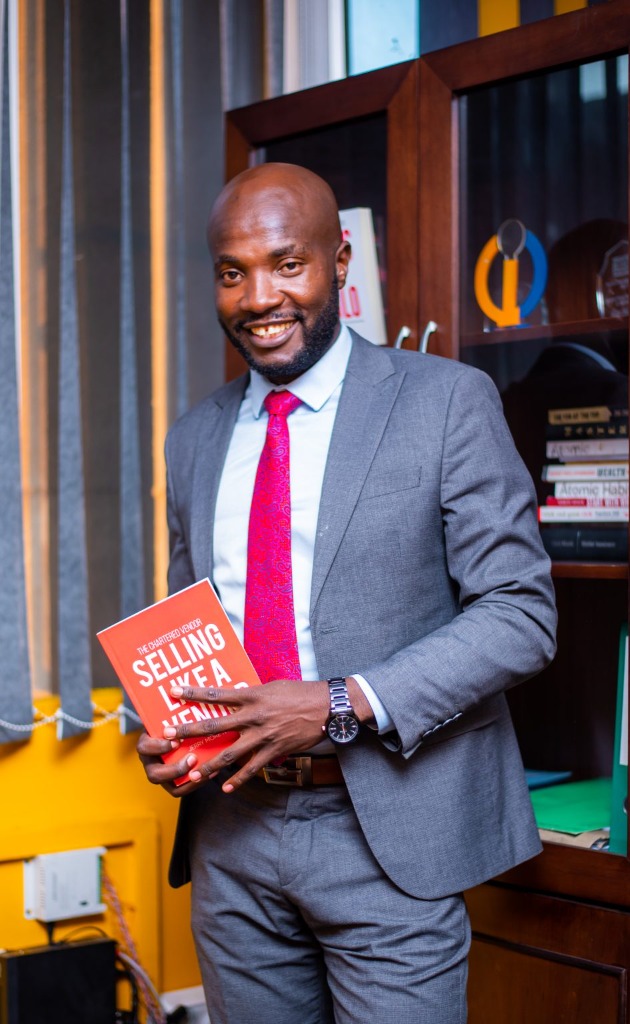

By The Chartered Vendor

#ZimbabweBusiness #FamilyTrusts #WealthProtection #AfricanEntrepreneurship #EstatePlanning #BusinessWisdom #FinancialEducation #LegacyBuilding #TrustManagement #AssetProtection #BusinessAdvice #CharteredVendor #AfricanBusinessCommunity #SecureYourLegacy #GenerationalWealth #EntrepreneurMindset #SmartBusinessAfrica